|

| Credit Score |

Credit reports are simply a way you can track record of your payment history over time and its a vital tool in the hand of a potential lender in case of accessing loans.

A persons credit score is like a school grade that you can use to assess a student's performance . It’s a cumulative number that measures your success relative to others, in this case grading you as a credit-worthy individual.

A persons credit score is like a school grade that you can use to assess a student's performance . It’s a cumulative number that measures your success relative to others, in this case grading you as a credit-worthy individual.

Money lending firms, insurance company, landlords or individual assign interest rates based on what bracket your score falls into. It's a measure of figuring out how responsible a person is.

FICO is a company that has a widely accepted score for grading credit, this score ranges from 300 to 850. On the FICO scale the higher the number, the better. In general, anything over 740 is considered excellent and will qualify you for the best rates: if your score is below 650, you’ll pay very high rates on loans and credit cards, if you qualify for the loan at all.

How is my credit score generate of calculated

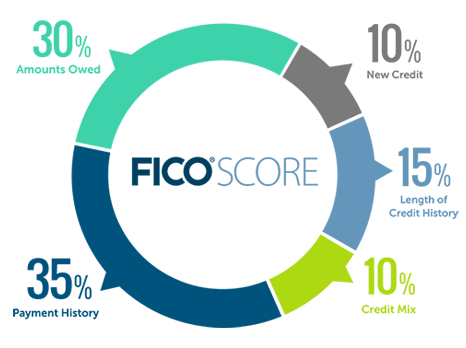

Your credit score is generated based on the information in your credit report. Fair Isaac, the makers of the FICO score, is tight-lipped about exactly how the scores are calculated. But they do give the weights of various criteria that they look at: 35% payment history, 30% amount owed, 15% length of history, 10% new credit, 10% types of credit used.

The most important factor in determining your score, payment history, is simply a record of whether you’ve paid your bills on time. The second more important, amount owed, is a little more complicated. It looks at how much you’re using of the total credit you have available – also known as your “utilization ratio.” Lenders believe that borrowers who are close to maxing out their credit are more likely to miss payments. The third factor, length of history, is determined by the average age of your accounts, as well as how long it’s been since those accounts were used. The two smallest factors are how often you’ve opened new accounts (opening a bunch at once will hurt your score), and whether you’ve got a mix of different types of credit (such as a mortgage, student loan and car loan). Lenders like to know that you can manage different kinds of accounts responsibly.

How to check your credit Score in Nigeria

CRC Credit Bureau Limited,

is a private limited liability company in Nigeria. it was established by a

consortium of Eleven (11) leading Financial Institutions and Dun &

Bradstreet with the purpose of delivering credit bureau services in

Nigeria.

CRC Credit

Bureau Limited provides a nationwide information repository on credit

profiles of corporate entities as well as consumers, thus improving the

ability of credit providers to make informed lending decisions. We are

the leading credit bureau company in Nigeria with credit information of

over 95% of the Nigerian credit industry covering commercial banks,

non-bank institutions, retailers & utility service providers. Access

to our credit information database enables creditors to effectively

assess the credit worthiness of new and existing customers for credit

offers while taking advantage of our technology driven product offerings

to develop new credit products.

No comments:

Post a Comment